The end of the year is fast approaching and with it the final opportunity to immediately expense any equipment or software purchases. This means that any equipment or software that is purchased and put into service by December 31, 2018, can be 100% deducted from your taxes.

We are not tax professionals, make sure to speak with a CPA or accountant to determine exactly how your business can take advantage of these manufacturing tax credits.

How is this possible? By using Section 179 for Manufacturing Tax Credits

What is Section 179?

Section 179 was put in place to encourage businesses to invest in themselves rather than overseas and gives small businesses the opportunity to maximize their purchasing power. Previously, companies could only write off a small portion of equipment purchases each year but new laws allow the total cost to be written off on your 2018 taxes.

Software and Equipment Purchasing Deadlines:

All products must be financed/purchased and put into service by December 31, 2018. in order to take advantage of this tax incentive you must make purchases with 3 HTi by the following deadlines:

- December 14, 2018: For all hardware purchases and our printer trade-in program

- December 27, 2018: For all software

Section 179 Limitations

When filing your 2018 taxes, the following limitations will be in effect:

- Deduction limit: $1 million

- Spending cap on equipment purchases: $2.5 million (phases out on a dollar for dollar basis and is completely eliminated after $3.5 million)

- Bonus depreciation: 100%.

What qualifies for Section 179?

Equipment and Bonus Depreciation

Under Section 179 both new and used equipment purchases can be deducted. The only requirement for used equipment is that it is new to your business. In addition, if you are over the Section 179 spending cap in 2018 you can take advantage of 100% bonus depreciation deductions for both new and used equipment. This deduction isn’t available every year, so if you are considering making purchases this would be a good year to do it.

When calculating your potential deduction amount remember that Section 179 deductions will be taken first and then bonus depreciation.

Any 3D printer purchased directly or through our 3D printer trade-in program by December 14, 2018 will qualify.

Software

Any off-the-shelf software available to the general public qualifies for Section 179. If it is custom software or is off-the-shelf with a significant amount of custom coding added, then it does not qualify for this deduction. It must also meet the following requirements:

It must be . . .

- Purchased or financed with a qualifying lease or loan

- Used within the business for activities that produce income

- Have a determinable useful life

- Be expected to last for more than 1 year

- Be readily available to the general public for purchase

- Subject to non-exclusive license (not just yours)

It must not be…

- Substantially modified or use any custom coding

- Databases or similar software (unless it is in the public domain and is required for otherwise qualifying software to operate)

- Software for creating or running a website (although this could change in the future)

Any software purchased by December 27, 2018 will qualify (this also includes any software upgrades).

Remember: Equipment and software must be purchased and put into service by the end of the year – so don’t wait until the last minute or you could miss out.

What should you purchase to take advantage of Section 179 Manufacturing tax credits?

What you should purchase to take advantage of Section 179 truly depends on your organization’s unique needs. We recommend taking a look at what equipment could use upgrades and considering what your future goals are.

What you should purchase to take advantage of Section 179 truly depends on your organization’s unique needs. We recommend taking a look at what equipment could use upgrades and considering what your future goals are.

Equipment and 3D Printer Trade-In Program

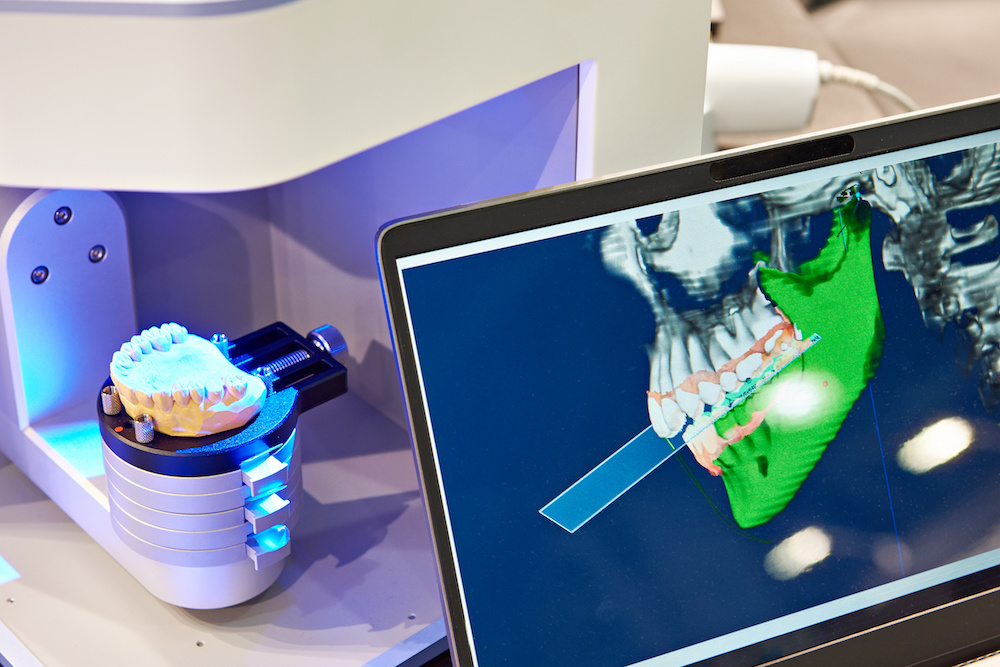

- Markforged Printers:

- EnvisionTEC Printers:

- Viridis 3D Printer: Create custom sand molds, mold cores, and investment casting patterns in a matter of hours using Robotics Additive Manufacturing (RAM) technology.

- 3D Bioplotter: Print with almost any material for a range of biomedical applications including biofabrication and biocompatible scaffolding.

- SLCOM 1: Industrial-scale printing for large parts up to 25 cubic feet or for large number batch printing.

- High-Resolution 3D printers: EnvisionTEC offers a range of printers with incredible precision from their Micro, Perfactory, and 3SP printing lines.

3D Printer Trade in Program:

If you’re looking to upgrade or change the capabilities of your printer to have more material options, improve accuracy and reliability, or are looking to eliminate post-processing now is the perfect time to purchase.

Get the trade in value1 for your old 3D printer when you purchase any new printer by December 14, 2018.

Software

- PTC Creo: Create the products of tomorrow with this industry-leading CAD software including tools for topology optimization, Augmented Reality (AR), and more.

- PTC Windchill (PLM): Manage the complete product lifecycle with the PLM platform that helps you create smart and connected products.

- ThingWorx: Leverage the latest digital transformation technology and create AR experiences within minutes.

Take Advantage of Section 179 with 3HTi

As a 3D printer and CAD software reseller, we have plenty of options for you to take advantage of Section 179. But time is running out! Remember, equipment and software must be purchased and implemented before the end of the year. In order to complete processing and shipment and/or implementation, all equipment purchases must be made by December 14 and all software purchases must be made by December 27.

Financing Options Available

Not ready to pay for your products in full? Take advantage of our partnership with Complete Capital Services to finance this year’s purchases. Up to 100% financing available. Apply Now.

Have any questions about our products? Contact us to take advantage of Section 179 before time runs out!

1 Trade-in value based on machine type, age, and condition.

2 3HTi is not a licensed CPA firm and is only providing tax advice for educational purposes. All specifics should be discussed with your accountant directly.